Italian Glasses? Smart.

Monday, June 14, 2021 at 1:58PM

Monday, June 14, 2021 at 1:58PM

Parallel to the tech industry’s own decade-long R&D investment, and strategic pursuit of consumer smart glasses, a second battle has been playing out in near choreographed tandem, yet virtually invisible to most inside the Silicon Valley bubble.

If the tech industry’s watershed date of April 15, 2013 saw the introduction of Google Glass crystallizing the tech industry around the pursuit of the next logical human-machine paradigm—that smart glasses are inevitable—across the pond a completely unrelated set of events were put in motion that have reconfigured the premium eye-frames market.

While these two sets of unrelated events have unfolded on the same timeline, most in the tech industry remains blissfully unaware—unaware of the companies concerned, the players involved, or the dynamics shaping the industry.

This article will educate on where the eye-frames industry has been, where it’s going, and in some specific cases of interest where it has already intersected with the tech industry, in order to enlighten us to where opportunities exist.

In March of 2013 the French conglomerate of Pinault-Printemps-Redoute (PPR) announced their rebranding as Kering—the culmination of an earlier transfer of power from father to son, that in turn led to a corporate restructuring.

François Pinault (the elder) had diversified the lumber yard he founded in the 1960s into other industries and interests across the French economy, and eventually ran the holding company’s investment portfolio a bit like a private equity firm, with substantial investments across many French industries. Most notably, through this diversified national investment strategy, by the late 90s PPR had acquired shareholder dominance in the French fashion house of Gucci.

The chairmanship and reins of the family empire were fully transferred to François-Henri Pinault (the younger) in 2005 who—through a process of asset liquidation, and subsequent acquisitions—moved the company his father built from a diversified national conglomerate, to a vertically integrated global fashion and luxury goods brand stable—flipping from >90% French domestic revenue, to >90% international revenue.

The chairmanship and reins of the family empire were fully transferred to François-Henri Pinault (the younger) in 2005 who—through a process of asset liquidation, and subsequent acquisitions—moved the company his father built from a diversified national conglomerate, to a vertically integrated global fashion and luxury goods brand stable—flipping from >90% French domestic revenue, to >90% international revenue.

As part of their rebranding and reorganization, Kering did extensive research on the international fashion and luxury goods industry, leaving nothing to assumption or conventional wisdom.

One question Kering wished to answer: What is the first brand touch-point of a Gucci buyers who becomes a lifelong customer?

The conclusion? Sunglasses. There was just one problem…

…Gucci eye-frames were not even made by Gucci, or by Kering at all, but through a brand licensing deal with Italian eye-frames manufacturer, Safilo. Not only was this true of Gucci, but this kind of licensing arrangement was common practice—the entire industry was structured this way…

Back in Silicon Valley, in May, 2014 Google Glass were first made available for purchase by the public through their Explorer Edition, setting off shockwaves in the tech industry that have compounded into the driving force for the largest R&D investment made across Apple, Microsoft, and Facebook, in their collective histories.

In September, 2014, Kering unveiled their plan to consolidate their brand stable’s eye-frames under their own umbrella. Not only did they launch a subsidiary, Kering Eyewear, and negotiate with Safilo a €90M payment to terminate their Gucci brand-license early, they also poached Safilo’s own CEO, Roberto Vedovotto, to build Kering’s new eyewear business unit. At that time Safilo was the second largest eye-frames company in the world (second only to Luxottica).

Kering’s move roiled the fashion world, resulting in an industry-wide realignment still reverberating through the global fashion and eye-frames industries to this day.

These two industries—tech and eyewear—have been moving headlong on a course of collision and convergence ever since. Probably the greatest misunderstanding about the emerging consumer smart glasses market is that this is a battle between Apple, Google, Facebook, Microsoft, Amazon (or insert your favorite indy, whether that be Vuzix, MagicLeap, etc.).

Premium eye-frames are a pre-existing $148B global market. The adjacent optometry industry is a $61B market. Completely apart from smart glasses, both are aggressively growing markets in their own right, and that’s without mentioning other adjacent industries like vision-care insurance.

If there is a battle at all, it could more accurately be framed as one between the tech industry as a whole, and the existing eye-frames and eye-care industries, because the decision in the minds of consumers will not be whether to purchase Apple glasses, or Google glasses, or Facebook glasses, or Amazon glasses, etc. The question will be, do they buy smart glasses at all, or do they continuing wearing their existing eye-frames, and sunglasses.

In March of 2014, Google announced that they would be launching versions of Glass in partnership with Luxottica, co-branded with two of their house brands: Ray-Ban, and Oakley. This co-branded product development was negotiated by then Luxottica CEO, Andrea Guerra.

In a story that first broke in the business section of Corriere della Sera, Italy’s leading newspaper, Luxottica’s founder and Chairman, Leonardo Del Vecchio, was alleged to have had a disagreement with Guerra over the Google contract, a decision some felt placed the reputations of two of Luxottica’s house brands at risk, through association with Glass—a product which by this time was experiencing substantial social backlash (wearers had by some acquired the unenviable moniker of “glassholes”). According to this version of the story, Del Vecchio wanted Luxottica to withdraw from the contract, while Google’s team steadfastly held Luxottica to the negotiated terms.

Del Vecchio contested this framing.

Guerra had been CEO of Luxottica for a decade at this time. He was not new in the role, and up to then his performance was widely praised—Luxottica’s market cap tripled under his tenure.

Nonetheless—whatever the source—the row between Guerra and Del Vecchio achieved operatic heights in the Italian trade press, reaching a crescendo on the first of September when Guerra’s termination was announced.

In spite of Guerra’s departure, the Google contract reportedly remained immovably in place, as Del Vecchio was quoted in the Wall Street Journal as being embarrassed by the scandal, having played out rather publicly. The business press was assured the Google contract would nonetheless be honored, and the story went away… yet no Luxottica / Google cobranded glasses under the Ray-Ban or Oakley labels ever shipped.

Further—now seven years later—Luxottica and Facebook are scheduled to ship consumer smart glasses, cobranded with the Ray-Ban label later this year. Now would be a good time to get to the bottom of whatever happened to the ill-fated Google / Luxottica partnership.

Apple is also preparing to launch a smart glasses product.

Four days after Guerra’s exit from Luxottica, news leaked that one time design director of Ikepod watches—famed Australian industrial designer, Marc Newson—had joined Apple. In another four days they would unveil the Apple Watch.

Peculiarly unmentioned in the tech-press coverage of the Apple Watch announcement was that Newson had also just launched another wearable accessory: a line of eye-frames for Luxottica competitor, Safilo. At this time Apple had already begun their streak of augmented reality related patent filings and acquisitions. What contact, if any, had Apple had with Safilo regarding smart glasses? Another reasonable question that no one in the tech press seemed interested in asking.

Given the loss of the Gucci contract (and their CEO), as well as the eminent expiration of Kering’s others brand licenses, any incoming CEO at Safilo would have an unenviable task upon arrival. The ever-so-recently renowned Italian eye-frames manufacturer was now maligned. An executive search for a qualified CEO would be difficult, unless they could find someone from within the firm to step up, and take the reins.

A recent Financial Times biography described Luisa Delgado’s career as a “mosaic.” The Swiss executive launched her career at the European arm of American consumer package goods giant, Procter & Gamble, eventually leveling-up to Managing Director of Nordic operations (Denmark, Finland, Iceland, Norway and Sweden), before holding executive and/or board positions across a broad range of industries including Swedish furniture manufacturer, IKEA; German software firm, SAP; British investment bank, Barclays; and at this stage of our story, Safilo.

A recent Financial Times biography described Luisa Delgado’s career as a “mosaic.” The Swiss executive launched her career at the European arm of American consumer package goods giant, Procter & Gamble, eventually leveling-up to Managing Director of Nordic operations (Denmark, Finland, Iceland, Norway and Sweden), before holding executive and/or board positions across a broad range of industries including Swedish furniture manufacturer, IKEA; German software firm, SAP; British investment bank, Barclays; and at this stage of our story, Safilo.

Stepping from her board director role into CEO, Delgado quickly looked to establish new brand license deals to offset the revenue loss from the Gucci exit. Other Kering brand departures would be imminent. New brand licenses would be needed, licenses not entangled with the large French fashion stables who had suddenly turned fickle—fickle not just at Kering, but now in a contagion extending to their largest rival LVMH, one for which Safilo also held prominent eye-frames licenses. The crown jewels of the LVMH stable—their Louis Vuitton namesake, as well as Dior—were both coming up for renewal.

Another puzzling mystery regards Safilo’s preexisting relationship with Marc Newson—what if any contact might Safilo have sought to established with Apple, regarding potential future smart glasses?

Before the end of this story, we’ll get to the bottom of this mystery, as well as the Google / Luxottica contract that never materialized… but for now we’ll wrap some needed context around the premium eye-frames industry.

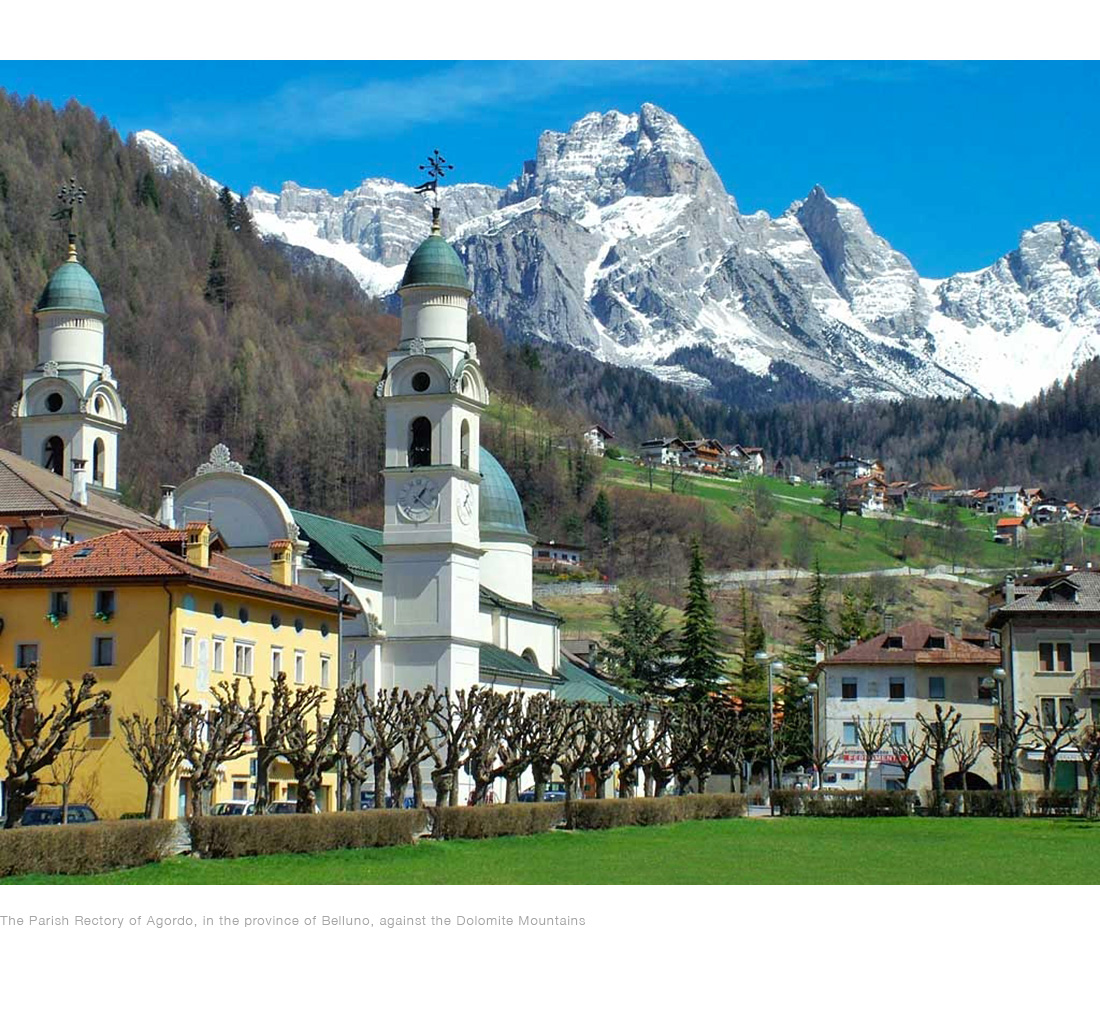

Leonardo Del Vecchio’s father died when he was five-months old, and his mother, destitute, turned him over to a Catholic orphanage at age seven. Raised by nuns, at fourteen the young Del Vecchio began an apprenticeship as a tool & die machinist at a factory in Milan, eventually earning enough to take evening classes in industrial design. With this experience, in his twenties he would relocate to the North Italian town of Agordo, in the province of Belluno.

Leonardo Del Vecchio’s father died when he was five-months old, and his mother, destitute, turned him over to a Catholic orphanage at age seven. Raised by nuns, at fourteen the young Del Vecchio began an apprenticeship as a tool & die machinist at a factory in Milan, eventually earning enough to take evening classes in industrial design. With this experience, in his twenties he would relocate to the North Italian town of Agordo, in the province of Belluno.

(He was not the only one.)

Agordo is a small factory town near the Austrian border. Even in the era of the youthful Del Vecchio, the mountainous region known as the Dolomites—part of the Italian Alps—was already home to Italy’s famed eye-frames industry. This was principally due to Safilo, then located in the Belluno municipality of Calalzo di Cadore. Safilo was established in 1934 when its own founder, Guglielmo Tabacchi (1900-1974) acquired Carniel, Italy’s “original” eye-frames factory (built in 1878). Other smaller optical companies built up around it. The region has a long history in spectacles.

Del Vecchio initially worked for hire as a component supplier to other frames companies, and in 1961 he named his studio Luxottica. He had a vision that eye-frames could be elevated to a high fashion accessory on par with designer shoes, or fine watches. He sold his first pair of frames under the Luxottica name in 1967, and by 1971 he introduced his first full eye-frames collection.

Just a few miles away from Del Vecchio, also in the province of Belluno, another young designer in Longarone named Giovanni “Nanni” Marcolin would launch his eponymously branded Marcolin Eyewear—like Del Vecchio’s Luxottica studio—also in 1961.

The municipality of Limana, also in Belluno, is the home of De Rigo, the smallest and youngest of the “big four” Italian frames houses. It was founded first as Charme Lunettes by brothers Ennio and Walter De Rigo. Soon after, the brothers would acquire the brand right to “Lozza,” the namesake label of Carniel’s founder, Giovanni Lozza, giving both Di Rego and Safilo competing claims of heritage to Italy’s oldest eye-frames manufacturer.

The globally dominant, Italian eye-frames industry is comprised principally of these four companies (as well as a fifth American owned company, Marchon, that manufactures in Italy, that we’ll get to in time).

Also in the 70s, an American entrepreneur named Jim Jannard launched Oakley as a BMX and motocross sports apparel and accessories company. While his first hit product were “Oakley Grips,” for motorcycle handlebars, by the 1980s his stylized eye-frames had become their high-margin hit product, so much so that he discontinued motocross parts, and pivoted the company to apparel, leading with eyewear. Jannard and Del Vecchio’s paths would soon collide.

Also in the 70s, an American entrepreneur named Jim Jannard launched Oakley as a BMX and motocross sports apparel and accessories company. While his first hit product were “Oakley Grips,” for motorcycle handlebars, by the 1980s his stylized eye-frames had become their high-margin hit product, so much so that he discontinued motocross parts, and pivoted the company to apparel, leading with eyewear. Jannard and Del Vecchio’s paths would soon collide.

In the ensuing decades, Del Vecchio earned for himself a reputation as a visionary entrepreneur of ruthless ambition, growing Luxottica into an international juggernaut, and with an estimated personal net worth of just over $30B, becoming the wealthiest man in Italy, in the process.

Let’s take a closer look at the company Del Vecchio built.

A milestone in Luxottica’s history was partnering with famed Italian fashion house, Giorgio Armani. In 1988 Luxottica signed a brand license deal to manufacture and sell fashion eye-frames under the Armani name, establishing the fashion brand licensing strategy that they would master, and which would become the norm throughout the eye-frames industry.

In 1990 Del Vecchio took the company public, listing on the New York Stock Exchange. The 90s would see fabulous growth, largely through acquisition.

Corporate raider style, in 1995 Luxottica successfully staged a hostile takeover of United Shoe Corp. If this seems an odd target, United had diversified out of shoes. Luxottica’s goal was to get control of United’s wholly-owned subsidiary, LensCrafters.

As Del Vecchio’s reputation as a cutthroat businessman grew, his two most infamous acquisitions were yet to come.

In 1999 Luxottica acquired Bausch & Lomb’s eye-frames business, the gem of the deal being Ray-Ban, America’s number-one selling sunglasses (It also came with the lesser known Revo brand, which Luxottica would sell-off in 2013).

Ray-Bans were effectively removed from the market, manufacturing relocated to Italy with state-of-the-art tooling and improved materials, the new Ray-Bans were brought up to Luxottica’s build quality. With the sales channel constricted, and inventory depleted, Luxottica relaunched Ray-Ban in 2004.

A pair of classic Wayfarers now retail for over $150.

While Bausch & Lomb exited the eye-frames market voluntarily, to focus on their contact lens business, not all brands succumbed to Del Vecchio’s will so gracefully.

Throughout the 90s, Oakley butted heads with many competitors, mostly over allegations of infringing on their design and engineering patents. Among others, Bausch & Lomb stood accused of making Oakley knockoffs, against which Oakley won a landmark case in 1995.

Jannard hired Scott Olivet—a former Nike VP over subsidiary brands. Interesting choice as Jannard had also fought a nearly five year long legal battle with Nike, with dueling counter claims of design infringements. Jannard had successfully leveraged IP to protect his market position in the past. He could be pretty ruthless himself.

With PearlVision, LensCrafters, Sunglass Hut, Target, and Sears points of sales all under Luxottica’s control, they could now effectively rattle Oakley’s stock price at any time by adjusting their volume of Oakley inventory.

Jannard, a billionaire, had much of his net worth tied up in Oakley shares (though publicly traded, he owned 68%). Any stock price slide placed Jannard’s own fortune at risk. He succumbed, and Scott Olivet negotiated Oakley’s sale to Luxottica. Jannard’s battle with Del Vecchio finally came to an end in 2007.

By this point in Luxottica’s rise they had begun to draw accusations of anti-competitive behavior from both the media and ambitious political figures, including then New York State Attorney General, Eliot Spitzer who launched a 2003 antitrust investigation into Luxottica’s business (it went nowhere); and nearly a decade later 60 Minutes, produced a 2012 exposé… also resulting in nothing.

Not only had Del Vecchio established himself as a competitor to be reckoned with, but also an untouchable Teflon Don. Business was good (and still is).

In January 2017, Del Vecchio bested even himself.

The Luxottica / Essilor merger was technically an acquisition. Essilor acquired Luxottica for $24B. One could be forgiven for thinking it were the other way around. In a post acquisition analysis, industry trade publication, Business of Fashion noted two developments driving the merger: the shakeup in the eye-frames brand-licensing model triggered by Kering, and the emerging consumer smart glasses market.

This would be a good time to take inventory of Luxottica & Essilor’s combined holdings. Essilor has a dominant (but not majority) position in the global corrective lens market.

While their core business focuses on corrective lens manufacturing, Essilor also entered the eye-frames market by acquiring FGX International in 2009. This included their name-sake Foster Grant eye-frames brand, a portfolio of licensed brands, as well as their extensive non-prescription “reading glasses” business. Foster Grant itself did not directly compete with Luxottica. They cornered a lower end of the market. Foster Grant frames and glasses can be found in sales channels like Walgreens and other pharmacies, at substantially lower price points.

Essilor brought other significant sales channels into the fold with both FramesDirect, then the leading online eye-frames retailer; as well as Vision Source, the U.S.’ largest eye-care franchise (and largest retailer, overall in the U.S. market).

Not all of their revenue are frames and corrective lenses.

Essilor is also a leading manufacturer of ophthalmic equipment. Because few of the manufacturers in the medical equipment space are exclusive to vision equipment, divvying up who controls how much market share is not easily sussed out. One industry report noted Essilor as the second largest player in the space behind Alcon, but ahead of Johnson & Johnson; however of those, only Alcon’s Annual Report separated out revenue from such equipment… and even there lumps it together as “Equipment/Other” at 16% of their $7.4B in 2019 sales (where possible I’ve tried to avoid referencing 2020 reports, as the pandemic threw numbers into disarray). Johnson & Johnson doesn’t distinguish vision equipment revenue from other medical devices, and so on, down the list. Nonetheless the combined EssilorLuxottica is a major player in the medical vision-equipment space.

Essilor is also a leading manufacturer of ophthalmic equipment. Because few of the manufacturers in the medical equipment space are exclusive to vision equipment, divvying up who controls how much market share is not easily sussed out. One industry report noted Essilor as the second largest player in the space behind Alcon, but ahead of Johnson & Johnson; however of those, only Alcon’s Annual Report separated out revenue from such equipment… and even there lumps it together as “Equipment/Other” at 16% of their $7.4B in 2019 sales (where possible I’ve tried to avoid referencing 2020 reports, as the pandemic threw numbers into disarray). Johnson & Johnson doesn’t distinguish vision equipment revenue from other medical devices, and so on, down the list. Nonetheless the combined EssilorLuxottica is a major player in the medical vision-equipment space.

Essilor also has a substantial IP portfolio including waveguides and other near-eye display technology. While Silicon Valley tech giants have vast troves of IP across all aspects of a smart glasses product, Essilor’s patent portfolio (specific to smart glasses) is more narrow—focused in optics, but it is noteworthy. Essilor does not have a large startup investment portfolio, but one investment that’s currently having a moment is DeepOptics, which spent years developing digital adaptive focus lenses, around which they currently have a Kickstarter to productize their adaptive focus technology into a pair of smart consumer sunglasses.

Essilor also has a substantial IP portfolio including waveguides and other near-eye display technology. While Silicon Valley tech giants have vast troves of IP across all aspects of a smart glasses product, Essilor’s patent portfolio (specific to smart glasses) is more narrow—focused in optics, but it is noteworthy. Essilor does not have a large startup investment portfolio, but one investment that’s currently having a moment is DeepOptics, which spent years developing digital adaptive focus lenses, around which they currently have a Kickstarter to productize their adaptive focus technology into a pair of smart consumer sunglasses.

While Essilor includes contact lenses among their product offerings, in a market dominated by companies like Bausch+Lomb, Alcon, Johnson & Johnson, and CooperVision, Essilor is not a leading player in contacts.

The combined manufacturing footprint of Luxottica and Essilor is both international, and staggering. Essilor has 27 international plants for fabricating prescription lenses, three more for photochromic (transition) lenses, and an additional three for sunglass lenses, with plants located on almost every inhabited continent except Australia. They then move the rough lenses through a network of 449 finishing laboratories around the world servicing regional retail, that mill and polish each pair of lenses to fulfill local prescription orders, and cut them to fit the desired frames.

Given that frames—unlike lenses—are not manufactured on demand, Luxottica’s operations do not require the edge manufacturing network of Essilor’s operations. They are nonetheless substantial and operate on multiple continents. They have one finished frames manufacturing plant each in southern California, Brazil, and India, as well as two component parts factories in China. While their supply chain is international, the largest portion of their manufacturing is still done in Europe, principally at their six frame fabrication plants in Italy, three of which remain in their founding province of Belluno: their Agordo, Sedico, and Cencenighe Agordino plants, respectively; one plant just to the south of Belluno at Pederobba, in the province of Treviso; one just to the west of Belluno at Rovereto, in the province of Trentino; and an additional plant in Lauriano, just west of Milan, approaching the French border. They also control a seventh fabrication plant in Italy through their Barberini subsidiary, located in Venice.

Further, as the owner of the U.S.’s second largest vision-care insurance provider, EyeMed; Luxottica also competes directly with Vision Service Plan (VSP)—America’s largest vision care insurance provider (who also service other international markets). We’ll look at them more later.

All of which leads us to Luxottica’s eye-frames brand licensing business…

It’s imperfect and surely even unfair—yet irresistible given my audience—to compare Hubert Sagnières to Gil Amelio, if only for Del Vecchio’s Jobsian takeover of his own acquirer. Hubert Sagnières retains his executive vice-chairmanship. It has been magnificent to observe, translated from the French and Italian business press, sometimes with drama. Del Vecchio never disappoints. Only in recent weeks has this struggle arrived at its inevitable conclusion… but for the moment we must catch up on some of the other threads, companies, and characters.

Let’s go back for a moment to early 2014—the Explorer Edition of Google Glass had been available to the public for about a year. While already working for Apple in secret, Marc Newson’s 80th Anniversary edition Safilo frames would be introduced that March. Seven days later Luxottica and Google would issue a joint press release on their strategic partnership. By September Apple held their teaser event, unveiling the Apple Watch just five weeks after Andrea Guerra’s ouster at Luxottica. Yet not only would the Luxottica-Google partnership never produce a product, no Safilo-Apple partnership precipitated either.

For years I’ve been determined to get to the bottom of these two matters.

What happened to the Luxottica-Google partnership? The tech press dutifully reported on it with much fanfare upon announcement… and seemingly forgot about it completely when no product materialized.

And what of Marc Newson’s eye-frames partnership with Safilo, while working on the Apple Watch? Was it really possible the subject of his existing product line at Safilo simply never came up internally at Apple, as they moved forward with smart glasses… with Newson then leading wearable product design, no less?

Seems implausible.

I finally got a break…

“You should talk to Colin Baden,” I was told.

When Oakley founder Jim Jannard commissioned a beach house on Orcas Island—the largest of the San Juan Islands, off the coast of Washington State—he hired architect Colin Baden, then a partner in the firm of Lewis Nelson Architects.

Jannard kept him busy.

He would subsequently hire Baden to design Oakley’s now legendary headquarters (shown above). With an unlikely career path—sharing an aesthetic vision—Jannard persuaded Baden to depart his architecture firm and head up Oakley’s industrial design studio. Under Jannard, Baden would also be elevated to the position of President, and once acquired by Luxottica, Baden would take the reins as Oakley’s CEO.

He would subsequently hire Baden to design Oakley’s now legendary headquarters (shown above). With an unlikely career path—sharing an aesthetic vision—Jannard persuaded Baden to depart his architecture firm and head up Oakley’s industrial design studio. Under Jannard, Baden would also be elevated to the position of President, and once acquired by Luxottica, Baden would take the reins as Oakley’s CEO.

Colin made himself accessible—indeed, within 24 hours of my outreach, we were on the phone. While divergent to our main storyline, I had to know the history of the Oakley Headquarters (I studied architecture myself, so humor me here).

Baden obliged.

Jim and I would watch science fiction movies and that was our inspiration—a bunch of, you know, great films that had great architecture in it, and that was how the building was created. I actually drew it in one night! My wife and I were living in a little cabin on Orcas Island—which is where we live now—that’s where Jim wanted to build his house. After dinner I just had this idea of what it should be and I drew it, drew it all night—it was a great; it was an amazing experience—faxed it to him, you know, fax machined long pieces of paper going through the machine at four in the morning. [laughter]

He said, “Do it!”

A great moment: “Go build it!”

Oakley was not your typical multinational, and we’ve established that Baden was not your typical CEO. I initiated my outreach because I wanted to get to the bottom of the Google / Luxottica cobranded glasses that never shipped. I also hoped to glean from Baden his own POV on the relationship between Silicon Valley, and the premium eye-frames industry. Few, maybe none would be as qualified.

When Apple partnered on their now forgotten first foray into cellphones with the Motorola ROKR featuring Apple iTunes, Oakley designed the accompanying headphone eyewear, the Oakley | Motorola O ROKR. Oakley has been shipping some form of designer smart glasses for almost two decades. Baden’s tenure bridged both the height of founder James Jannard’s success and the post acquisition period, where he rose to CEO of Oakley in the Luxottica era, including the time of the ill-fated Luxottica / Google contract.

How did this Google collaboration come about?

Oakley was the sharp end of the spear for Luxottica. We ran an R&D Department that they did not have when we were acquired, with a clear point of view about a multi-year evolution of innovation—AR was part of it. We obviously had a long history… and we were making products and selling in the marketplace. Some really successful, some not so successful, but it was all learning…

Given Oakley served as Luxottica’s smart glasses R&D department, the whole Google / Luxottica deal actually came in through them.

Sergey Brin approached Jim Jannard and said, “I’m havin’ trouble doing this Glass project. Would you take over the designer frames?” and Jim was, at that time, out of the Oakley picture. He said, “No, you need to go talk to my boys at Oakley, and do it with them.” and so Sergey and I met… He got his whole team in there. They were all wearing Google Glass, and we started having a conversation… and a short time later Oakley and our biz-dev team entered into a discussion with Google about helping them do their project. I thought it was a great representation of how progressive Luxottica and Oakley could be in the market place.

This meeting, Baden explained, took place before Glass had been revealed to the public—prior to April of 2012.

[Google] were very close… if [Glass] was going to have broad acceptance / adoption with what [Sergey] had created, he needed to partner with someone who made eyewear for a living, and we were the most progressive game in the marketplace.

How did it lead to the departure of Andrea Guerra? Turns out, it didn’t.

Baden explained that the Italian business press got everything wrong about the rift between Luxottica CEO, Guerra and founder, Leonardo Del Vecchio. The Wall Street Journal story was just following on, and by then it was probably impossible to stop the misrepresentation from circulating.

It was selling the Revo brand.

Along with Ray-Ban, the acquisition of Bausch+Lomb’s eye-frames business, also included the lesser known, Revo.

Andrea Guerra was a great guy to work for.

Baden elaborated how Guerra let the subsidiaries run with relative autonomy, particularly Oakley.

He respected the brand. He understood the concept that the brand was the culture, and the culture was the brand; and if you messed with that, what you bought would drop in value; and he let us have all the freedom in the world to do what we had been doing…

While Baden elaborated no further on Revo—after thirteen years Guerra decided to let the subsidiary go, and sold them to Sequential Brands Group, a New York based conglomerate. The Revo sale was hardly even a news story beyond a press release, even within the optician trade press.

So if Andrea Guerra’s departure had nothing to do with the Google contract at all, then why did no product result?

So what we did was, we tried to take what they had made, and blend it in to a series of frames that already existed in our portfolio… and… the way that that product functioned set very specific design parameters that you couldn’t work around…

Through other sources I had come to understand that Oakley’s team had concluded by November of 2015 that there wasn’t going to be a product, and by January of 2016 Google made a strategic decision to pivot to enterprise. It was mutually agreed upon that Luxottica was the wrong partner for an enterprise product, and the companies parted ways.

It was completely amicable. There [were] no bad feelings; everyone… you know, there was a product we had developed on the table, [but everyone] agreed… we weren’t going to move forward… and by that time… we were already with Brian Krzanich, the CEO of Intel at the time, and we were busy with a roadmap we were going to partner with them on… They had the interest to invest millions of dollars…

Another source who declined to be interviewed simply stated that lawyers were not even involved, that it was a ‘hand shake’ parting of ways.

Baden would go on to share some of his thoughts regarding the state of smart glasses and what was needed to succeed in the consumer market, and we’ll hear more of that, but having resolved the mystery of the Luxottica Google contract, we have the second mystery to solve…

What of Safilo, and did they ever interface with Apple?

For this we head back to Italy.

In the throws of transition, the struggling house of Safilo hired Nicola Belli as Head of Innovation. Belli, who had first made a name for himself in the space sciences division at Ferrari, was tasked with establishing Safilo’s wearable technologies studio for smart glasses.

In the throws of transition, the struggling house of Safilo hired Nicola Belli as Head of Innovation. Belli, who had first made a name for himself in the space sciences division at Ferrari, was tasked with establishing Safilo’s wearable technologies studio for smart glasses.

Belli, no longer with Safilo, agreed to talk.

I joined Safilo back in in November 2013 and that was more-or-less the time when Safilo got in touch with Google. They were probably talking to Safilo and other eyewear manufacturers because they knew that was something not working—from the eyewear perspective—in their product.

From the start, this was new information. Before the Google/Luxottica contract went into effect, Google executives toured Italy, and met with all the frames companies. Finding Safilo’s place in the smart glasses market was Belli’s responsibility.

…my main background is in aerospace engineering: I had been involved in the technology transfer for Formula One to the sporting goods industry, including integration of electronics; so I got involved with the evaluation and our intent was to test Google Glass for a few months to get an a better understanding of what were the limits that the product had both from the design and the eyewear manufacturing perspective. The outcome was not encouraging.

I was interested in the Marc Newson relationship, and the Safilo frames he designed while working on the Apple Watch.

You clearly see the design imprinting from Marc Newson, the shape is very similar to the Apple Watch. I guess he was experimenting his design style related to Apple into other products. That was a capsule collection under Safilo’s own core brand, not intended for mass distribution.

Safilo’s most successful house brand, SMITH, was a 1996 acquisition (originally based in Idaho, US). Besides being a sports eyewear brand popular among skiers and cyclists (form whom they’ve also made helmets), the SMITH division of Safilo is also a supplier of military grade tactical glasses whose customers include the U.S. military. Through their SMITH division, Safilo had some past experience with embedding headphones insides of sports helmets—and hints of perhaps other undisclosed military work—and was therefore the natural choice when exploring a Safilo house brand for smart glasses development.

In 2014 Belli traveled to CES seeking a technology partner, and initiated a relationship with INTERAXON, maker of the MUSE wearable EEG meditation device.

The design of MUSE headband was somehow resembling futuristic glasses and the level of miniaturization, integration of electronics and lightness was a good starting point to be applied in eyewear. Also the idea of brain signals monitoring was catching my attention: it was something I had experience with in the past when I was working with Ferrari, I was involved in project about a brain interface for astronauts to be flown on the Nasa Spacelab. The rising trend of mindfulness, combined with the opportunity to improve fitness and training in sport drove us to the idea that SMITH was the right brand to experiment the first smart eyewear at Safilo. So the Lowdown Focus was born.

I pressed Belli several times about Apple, and the Marc Newson relationship. Belli noted that he himself had no contact with Apple in his role, but dodged when pressed as to whether anyone else had.

Ultimately Safilo would end up partnering with Google.

When Google and Oakley/Luxottica agreed to part ways in early 2016 without producing a product, Google would re-engage with Safilo. They were seeking a partner to collaborate on the design of an enterprise product, and called on Safilo, noting their collaboration between SMITH and the U.S. military.

The result was the Google Enterprise Edition II.

Belli did opine on the Kering reorganization that saw the French fashion conglomerates pull all of their eyewear business under their own control.

Belli did opine on the Kering reorganization that saw the French fashion conglomerates pull all of their eyewear business under their own control.

The opening of this article gives an account of the creation of Kering Eyewear that I had corroborated via a phone interview with Kering’s communications department back in 2017. While Kering’s reorg was framed as a strategic decision around the long-term customer’s brand journey, Belli’s perspective was more practical.

The decision to move away from big manufacturers like Safilo, Luxottica, or Marcolin and verticalize design and manufacturing under their own controlling property and management is similar to what many fashion houses are doing on accessories like shoes, and handbags.

He saw it as more of an inevitability that these large vertically integrated fashion conglomerates would eventually bring their eye-frames in house.

Belli also shared some thoughts on Luxottica’s newest partnership with Facebook.

I’m very curious. My personal opinion is that the chances for electronics to become integrated in the proper way into successful eyewear sales are still limited by many usability factors: size, weight, battery life, eyes fatigue and distraction. There are opinions that in the future eyewear could become the replacement of the smartphone. Let’s see where innovation will drive us.

He was skeptical but if it came to pass, it would require somebody hitting upon, “the killer app of electronic integration into eyewear.”

Over the course of time, Google never launched a product with Luxottica, and they subsequently went on to work with Safilo; Luxottica is now working with Facebook; and Safilo never managed to work with Apple, in spite of their preexisting relationship with Newson.

I would finally make some progress, getting an answer about a possible Apple / Safilo relationship that could have been. Nobody, not even former Safilo employees since departed would speak on it… but one commented off-the-record, confirming indeed that contact was made, and that Apple, ‘did not feel that they needed us.’

I was encouraged to go to the top.

It was already my understanding that Newson’s relationship with Safilo was with former CEO, Luisa Delgado. While she declined to be interviewed for this article, she did agree to give a succinct statement regarding Safilo’s contact with Apple.

In my inquiry I specifically asked if she could both confirm that she had had contact with Apple in her time at Safilo, and if so—stretching a bit here—if she could clarify if the overture to collaborate on smart glasses was declined by Newson, Ive, or Cook.

Here is Delgado’s unedited statement:

Engaging with high profile brands on potential licenses and collaborations is top priority at a licensee company like Safilo. The highest end leads, like Apple or any other leading design/lifestyle/luxury brand would typically be owned directly by the CEO, others would be led in conjunction with the License VP, the rest only by the latter. As such indeed I contacted Apple, and selected other brands over my five years at Safilo, during which a series of licenses were signed and collaborations struck, and several others not. Indeed Apple was part of the latter, they declined to pursue beyond the initial approach. I’d personally consider information such as with whom exactly I engaged and how the conversation went as a reserved matter between parties

Professional.

LVMH was slow to respond to the reorganization of Kering’s eyewear business, but by January 2017 the other shoe dropped. News leaked that LVMH was in talks with Marcolin, possibly even an acquisition. Safilo’s stock price tanked, dropping 14% on the news. To calm the market, Delgado went to the press pitching her strategy to build a new license portfolio with less exposure to the French fashion houses.

Having guided Safilo through its darkest hour, within a year Delgado would step down from her glass cliff, to be replaced by Andrea Trocchia, former CEO of Unilever Italy.

For their part, Kering Eyewear would acquire the Cartier Lunettes eye-frames factory in Sucy-en-Brie from Richemont—finally bringing manufacturing in house, in earnest—where Richemont took a 30% stake in Kering Eyewear, as part of the deal.

With Kering Eyewear consolidating both Kering and Richemont’s brands; and LVMH and Marcolin creating the Thélios subsidiary, we can now have a look at the new brand licensing landscape, Starting with Safilo.

Even in spite of the Kering and LVMH losses, Safilo maintains a formidable collection of brands licenses. In 2019 dutch private equity firm, HAL Investments increased their stake in Safilo to 49.84%. They remain listed.

Safilo has made some strategic purchases. In December 2019 they acquired Blender Eyewear, followed quickly by another U.S. acquisition, Privé Revaux, that closed in early February 2020. The former came with e-commerce success, and the later with online celebrity affiliations and a strong social media presence—both youth-focused American branded.

Safilo has also made some strategic sales. Last year they sold off a manufacturing plant in Martignacco, and the year before they unloaded U.S. retail chain Solstice Sunglasses to buyer Fairway Eye Center.

They have made headway in Asian markets, entering a South Korean joint venture with Parma—Safilo as the majority owner—offering many of their brands through Korean sporting goods sales channels.

Trocchia has also secured some new brand license contracts including the first eyewear line for designer, Isabel Marant, as well as last year’s launch of a new David Beckham branded eyewear line. While the former may be a niche play, the later will expand their presence in sports and likely—along with SMITH—be a benefactor of their aforementioned Korean distribution venture.

In spite of all of this, Safilo’s stock price remains sluggish… I would suggest—as I have long suggested—that they are undervalued.

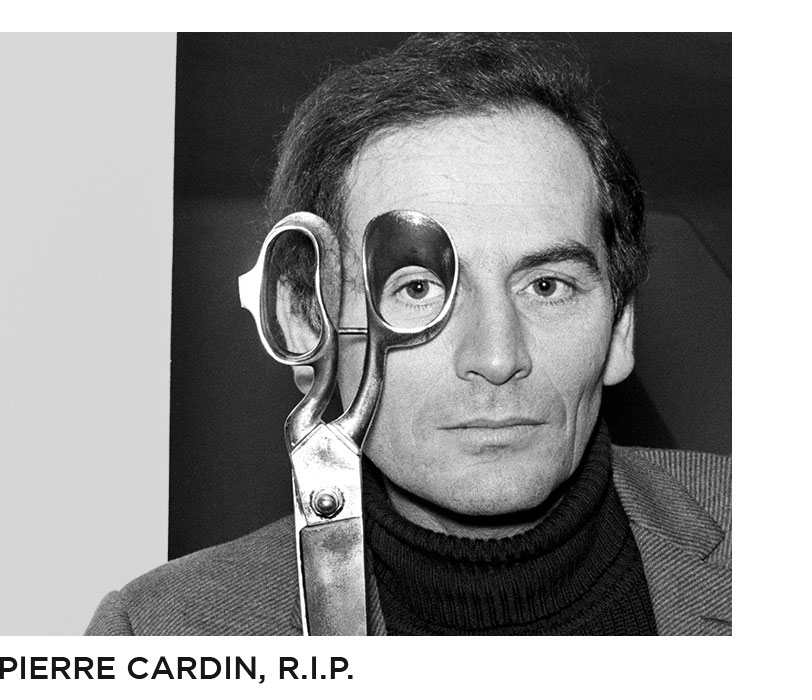

Safilo did suffer a symbolic blow earlier this year with the recent death of Pierre Cardin. As a designer, Cardin perhaps more than any was responsible for elevating eyewear as a fashion-statement accessory on par with handbags and designer shoes, within his own collections. His frames were produced by Safilo and so also helped elevate the Italian manufacturer’s prestige in the world of high fashion.

Safilo did suffer a symbolic blow earlier this year with the recent death of Pierre Cardin. As a designer, Cardin perhaps more than any was responsible for elevating eyewear as a fashion-statement accessory on par with handbags and designer shoes, within his own collections. His frames were produced by Safilo and so also helped elevate the Italian manufacturer’s prestige in the world of high fashion.

But Safilo’s solid performance has likely been obscured by immediate rival, Marcolin, who more than any other has been the winner in the reshuffle—capturing opportunity within chaos—from the eyewear industry’s upheaval.

Marcolin also had exposure to the French fashion houses, yet LVMH took a very different approach than Kering. While Safilo lost all Kering’s and LVMH’s licenses, Marcolin only lost one Kering eyewear license, Balenciaga, and one Richemont license, MontBlanc (Luxottica continues to hold LVMH’s Bulgari license until 2023, but can be expected to join Thélios’ stable of brands, at that time). By contrast, through their Thélios joint venture with LVMH, Marcolin gained the full stable of LVMH brands that Safilo lost, while continuing to service (and expand) their own collection of brand licenses through Marcolin proper. They do have some weakness with their house brands.

Also one peculiar anomaly: in 2018 Stella McCartney bought out Kering’s stake in her own eponymous label, then brought it into a negotiated partnership with LVMH, hence being the only major fashion label that has “changed houses.” This shuffled McCartney’s eye-frames license again. She had already moved from Safilo to Luxottica before the Kering eyewear reorganization took place, but more recently Luxottica lost her license in the move to Thélios (she likes to renegotiate).

Meanwhile in Asian markets—this past December Marcolin bought out Ginko’s stake in Gin Hong Lin International Co. Ltd., making it a wholly owned subsidiary. Gin Hong Lin was previously launched as a joint venture between Marcolin and Ginko Group—China’s largest contact lens company—at the time doubling Marcolin’s manufacturing capacity with the stroke of a pen. Now they are in full ownership of their Chinese operations. Also, to be clear: the frames that Marcolin is selling through their Chinese subsidiary, into the Chinese market are manufactured at their factory in Italy.

Amidst the pandemic, Marcolin also changed leadership, bringing in a new CEO, Fabrizio Curci. Coming to Marcolin as the former CEO of Fiera Milano, Italy’s largest trade fair organizer—which also manages Milan’s largest exhibition space of the same name—but Curci is perhaps more known as the former Fiat-Chrysler executive who previously ran Alfa Romeo.

In recent weeks it was also announced that former Luxottica CEO, Andrea Guerra—he who had the rather public falling out with founder Leonardo Del Vecchio back in 2014—has now joined the board of Marcolin’s LVMH joint venture, Thélios. While understandable hype and a dose of rumor swirled in the Italian business press around Guerra’s appointment to the board, he will not be running the firm, nor will he be departing his existing position where he has been the CEO of LVMH’s luxury hospitality group since early last year. This is, in a sense, a return to Guerra’s roots, having spent his early career as marketing director at Marriott. While his principal attention may be focused on growing LVMH’s footprint in the luxury hospitality space, it seems only reasonable that the former CEO of Luxottica would join the board of LVMH’s eye-frames subsidiary, given he’s already in the house.

If I had his ear, I’d tell Arnault to get his former CDO, Ian Rogers into a Thélios board seat, but so far he hasn’t asked.

In 2012 the French private equity fund, PAI Partners acquired control of Marcolin, and delisted it. PAI claims an average exit time of five years. They’ve been in control of Marcolin for nine. Just days ago Marcolin issued a €350M Senior Secured Notes Offering.

Given that Marcolin’s Thélios joint venture with LVMH was precipitated in response to Kering’s launch of their own eyewear subsidiary, we should see what the Kering-Richemont catalog of brands now looks like.

As of January 2021, Kering Eyewear is now firmly in control of Kering’s stable of fashion and luxury brand licenses, as well as the brand licenses of Richemont.

Richemont is the third largest fashion and luxury goods conglomerate after LVMH and Kering. Kering’s strength in fashion apparel compliment Richemont’s strength in jewelry and watches. The two have little direct competition with one another, while LVMH is the largest competitor for both. The joint venture in eyewear has added fuel to long speculation of a future mega-merger that appears closer to inevitable with each passing day. Last month Richemont Chairman, Johann Rupert confirmed that Kering had made past overtures while simultaneously assuring the media of his lack of interest in selling. This is of course all part of the dance—simply making these conversations publicly known fluffs Richemont’s stock price—I’m confident Pinault will eventually find Rupert’s price.

Among the Italians let’s see the smallest notable actor, De Rigo.

In 1995 De Rigo was publicly listed on the New York Stock exchange, only to have the De Rigo family launch a take over bid, delisting ten years later (2005). They operate a factory in Langarone, and also have a small footprint in optician retail in Europe, owning chains in Spain, Portugal, and Turkey, as well as a joint venture in the UK, Boots Opticians, with the American pharmacy retailer, Walgreens. They have subsidiaries in several countries, notably Australia. De Rigo also has a peculiar second line of business in commercial refrigeration units (yes they do).

Throughout North Eastern Italy, and the Belluno region in particular there are many other independent eye-frames manufactures, part suppliers and other companies offering supporting services.

Over the years Luxottica has occasionally caught the attention of regulators and media alike, frequently framed as a “monopoly.” One thing I hope this overview of the Italian eye-frames industry has shown is—in spite of Luxottica’s dominant market position—what a dynamic and hotly competitive market the premium eye-frames industry is… and we have not even ventured beyond the borders of Italy and France.

Back here across the pond we have Marchon, the U.S.’ largest eye-frames manufacturer, itself acquired in 2008 by VSP for $735M. VSP took Marchon private, and rolled their existing eyewear subsidiary, Altair into the larger Marchon business.

In spite of Marchon’s faux-French branding, it is an American company based on Long Island in Melville, NY. Nonetheless most of their frames are manufactured at their plant in Alpago, Italy… yes, in the heart of Belluno.

VSP is a unique entity in its own right. The vision care insurance provider had historically been run as a nonprofit, with a board dominated by independent optometrists whose industry they serve. Luxottica’s ownership of EyeMed makes the Italian giant VSP’s largest direct competitor in vision care insurance.

As vision-care chainstores grew, VSP expanded to provided more services to independent eye-care professionals to help their network remain competitive. In addition to launching their in-house eye-frames label Altair in the early 90s, the California based entity eventually expanded their offerings to include everything from their own line of corrective lenses and a network of optical labs to service their partner network; as well as business management software specialized for running a vision-care practice.

They also manage multiple innovation laboratories, developed a pair of health-tracker smart glasses branded Level, and have been forward-leaning in the smart glasses space in their own right. They collaborated with Google on a pair of Diane Von Furstenberg Google Glass frames, and have been proactive in ensuring their insurance coverage will adapt to the coming smart glasses market.

In 2008 VSP lost its U.S. nonprofit status, but it continues to run their holding company as a Not for Profit, that has privately held for-profit subsidiaries.

In 2011 VSP launched Eyeconic, an online eye-frames store that pays independent eye-doctors who provide eye-care support to the platform’s customers. In 2019 VSP experimented with it’s own brick-and-mortar eyewear locations under the Eyeconic brand name before then acquiring Visionworks—the sixth largest optical retailer in the U.S.—later that year. To be clear, VSP’s largest sales channel are the independent opticians and visioncare centers across the country.

In addition to the United States, VSP Global operates as a vision care insurance provider in Australia, Canada, Ireland, and the United Kingdom.

If you look at VSP and you squint your eyes, it begins to look at bit like Luxottica flipped upside down. Luxottica is a premium eye-frames manufacture that has built a vertically integrated operation encompassing corrective lenses, retail sales, and at the opposite end of their business, they offer vision care insurance. VSP Global is a vision care insurance provider that has built a vertically integrated operation offering corrective lenses, retail sales, and at the opposite end of their business they own an eye-frames subsidiary. Each of their core businesses could be described as being at the opposite end of their respective vertical—and a substantial piece of Luxottica’s business is in non-corrective sunglasses—but the inverted similarity is unmistakable. Further, VSP’s market dominance in their core vision care insurance business would suggest that more customers will come to Luxottica owned retail points of sale with a VSP insurance plan than Luxottica’s own EyeMed plan, so they must also play nice.

Historically Warby Parker’s frames have been manufactured in China.

Selling frames for cheap and undercutting the competition’s price by shipping manufacturing to China is the business model Warby Parker launched with. The buy-a-pair / give-a-pair glasses program was not a “business model,” it was the feel good PR component meant to generate positive press, to gloss over and misdirect attention from that business model. If you’ve ever worked in marketing and PR, this is understood. For whatever merit the program may genuinely have, and giving some befit of the doubt to the founders and their personal humanitarian inclinations, nonetheless business is business and so is the marketing calculus.

They have received heat in the past, under accusation of trying to obscure the Chinese origins of their manufacturing. This issue is not new for them.

As Warby Parker moves their brand up-market from a mail-order bargain frames supplier, into elite brick-and-mortar retail, they’ve also moved up market with at least some of their manufacturing. While most of their manufacturing remains in China, even Warby Parker has begun to move production of a few of their higher-end frames to Italy. Given that they promote heavily the “Made in Italy” origin of the few pricier frames that are, one can calculate by omission the majority of manufacturing remains in China. In 2019 Warby Parker Co-Founder & Co-CEO, Neil Blumenthal acknowledged their Chinese manufacturing origins, but declined to disclose specifically where, noting the confidentially of their sourcing relationships.

Perhaps their up-market retail will move more of their manufacturing to Italy over time. Their buy-a-pair / give-a-pair marketing campaign also appears to be phasing-out. In a December 2020 press release, WP quietly scaled the program back, replacing it with other perhaps legitimately more urgent social causes due to COVID19. In the future we will see if that program is reconstituted, or as they move past IPO, if the pressure of making quarterly numbers felt by a publicly traded company will cause it to be permanently disolved.

Warby Parker frames are designed in New York.

Even for frames manufactured in China, Warby Parker is widely understood to use acetate supplied by Mazzucchelli, an Italian plastics and chemicals company that specializes in the kind of Cellulose Acetate specifically used in the manufacture of eye-frames. They are a major supplier across the industry. New York based Marchon recently began using more recycled acetate from Eastman Chemicals in some of their frames, while Safilo recently partnered with DNV (Det Norske Veritas) of Norway to produced an eye-frames usable plastic recycled from the “Great Pacific Garbage Patch” (albeit for a one-off product). In order to accelerate development of more sustainable acetate options, this month Mazzucchelli took more outside investment, in this case from Luxottica who increased their ownership of Mazzucchelli to 35%. In this way Luxottica is underwriting R&D costs that the whole industry will benefit from.

Something noteworthy is that only Luxottica and Safilo have the full transparency of a publicly traded company. Kering Eyewear is a joint venture subsidiary of two publicly traded companies, Kering and Richemont, and therefore offers some degree of transparency by proxy. VSP is a Not for Profit which wholly owns Marchon as a for-profit, privately held subsidiary. In the United States an exceptional amount of privacy is afforded to privately held companies. Warby Parker is a privately held, venture backed startup. Marcolin was acquired by French private equity firm, PAI Partners but does continue to publish an Annual Report. This is likely reflective of both PAI’s desire to re-list, and the fact that Italy requires private companies to be more transparent than we do under U.S. law. As a consequence De Rigo, though also privately owned by the De Rigo family, publishes a minimal report to the requirements of Italian regulators. All of this makes the industry slightly more opaque than perhaps many other industries, while its largest player is the most transparent. Subsequently Luxottica receives more scrutiny partially because it is more easily scrutinized.

Although the acquired rather than the acquirer, at 32.3%, Del Vecchio remained the largest shareholder of the combined EssilorLuxottica, and retained his board chairmanship, though for an interim period of three years his voting rights were restricted. As such, any new CEO hired to run the combined company required both Hubert Sagnières’ and Leonardo Del Vecchio’s mutual approval. Throughout the merger Del Vecchio refused to approve any of the contenders to CEO. After an awkward bout of co-CEO management, Del Vecchio eventually bullied his own favored lieutenant into the role as a “temporary,” acting CEO for the remainder of the executive search. He then waited them out. Early this year, just as Del Vecchio’s voting restrictions were coming due to expire, he got enough of the board to approve adding his “acting CEO” and right hand man, Francesco Milleri to the board. With full voting rights restored, Del Vecchio has his hand-picked CEO both at the helm, and sitting on the board with him… and just like that, Del Vecchio’s people are in.

This has all happened just as Luxottica and Facebook are preparing to launch their first co-branded smart glasses under the Ray-Ban brand. Conventional wisdom says that Apple is positioned to dominate the smart glasses market. I have several reasons that suggest to me that this may not be so.

Conventional wisdom also says Apple leads in design.

But do they?

Can you name their Chief Design Officer?

No.

Jony Ive resigned in 2019. The position has never been filled.

More telling, Apple doesn’t list a single design or creative leadership position on the their company “leadership” page. Not one! …and they haven’t for over two years.

Ive’s departure was not itself a surprise. It was widely known that he had been preparing to move on for years. A smooth succession plan was in place. Ive hired Marc Newson as his heir apparent (who conveniently came in the door with recent eye-frames experience from Safilo)… but when Ive resigned in a power struggle with then VP of Supply Chain Management, Jeff Williams, Newson resigned along with him. Heading up supply chain management was Tim Cook’s position before Steve Jobs promoted him to COO (then acting CEO until Job’s passing). On the heels of Ive’s resignation Tim Cook placed Williams over the product design studio, and promoted him to COO, following his own career path, leading to the obvious speculation that Cook has his own succession plan in place. In a choice between who he valued most, Cook chose Williams, Ive walked, and much of the design leadership walked with him.

This is entirely Tim Cook’s Apple now.

Under Tim’s leadership Apple is an incrementalist and master of product iteration—a strategy that has made them staggeringly profitable in the Tim Cook era, in no small part due to Cook’s and Jeff Williams’ mastery of the supply chain (Apple’s innovative use of supply chain management to increase margins and retain market lead is a topic for another article… maybe by someone else).

After the passing of Steve Jobs, Jony Ive’s profile at Apple was raised substantially to fill the vacuum in the “creative visionary” department left by Jobs’ absence.

Apple’s reputation in “design leadership” is now coasting on past glory—its actual leadership gutted, and design demoted not only out of the C-Suit, but wiped clean from the executive management ranks all together.

To be clear, Apple is a huge company, and I’m sure there are still many talented industrial designers among the rank-and-file of Apple’s product design team, but Apple is no longer a design driven company. In the most literally sense, design no longer even has a seat at the table.

A decade ago Apple began hiring fashion executives. Paul Deneve, former CEO of Yes Saint Laurent; Angela Ahrendts, former CEO of Burberry; TAG Heuer’s former VP of Global Sales, Patrick Pruniaux. Ahrendts was the last to depart, just weeks before Ive’s own departure.

All of this, just as Apple is preparing for the launch of what ought to be the most fashion-forward, and design centric product in their history… and their design studio is being run by their supply chain guy.

In the consumer market, smart glasses will live or die by the value of design.

Colin is right.

People in tech often assume that the importance of style, of aesthetics only matters in high-fashion, effecting some small portion of the market.

To counter, I often share this anecdote:

Imagine yourself on a road-trip across the heartland of middle America. Maybe you’re in Kansas, or a lonely stretch of highway cutting across Nebraska—far from the epicenter of fashion. Pulling into a truck stop or a gas station, you observe a long-haul truck driver climbing down from his rig.

Perhaps he’s in overalls, work-boots and a greasy-billed baseball cap… that son-of-a-bitch will still be wearing a $200 pair of Oakleys.

Put another way: a cultural specimen one might size up as the least fashion conscious among us will still spend more money on a pair of sunglasses—that contain no electronics—than he spent on the Android phone in his pocket.

How we choose to frame our face matters to us a lot. How we frame our eyes matters to us even more. There’s an entire industry, mostly located in Italy, that not only knows this better than anyone, but have built a near $150B global industry around it.

You show me a consumer facing smart glasses product that doesn’t lead first with design, and I’ll show you an industry that is going to fail. It matters a lot, and particularly matters a lot to me, because I’ve invested a great deal of my soul, playing my own small part to nurture this industry into existence, and do not want to see it fail.

I want to make something else clear here: I’m a lifelong Apple guy. I’m typing this on my Mac, with an iPhone in pocket. I’ve been a Mac user since the late 80s.

Tim Cook still sits on the throne, but for the first time since Jobs bestowed Apple’s kingdom upon him, I’m uncertain he can defend it (the fact that this opinion is met with the shock of heresy by most in the industry only hardens my position). There are many pretenders to the crown. Evan Spiegel gave an excellent presentation for the new Snap Spectacles, then announced the acquisition of their lens partner, WaveOptics the following day—a company whose technology partnership with Luxexcel (waveguide inside a prescription lens) I ever so recently referred to as the technological “Holy Grail” for consumer smart glasses. Spectacles new form-factor made clear this isn’t really a consumer product, but a developer prototype.

To be clear, this is not a one horse race.

I look at Mark Zuckerberg—the undisputed frontrunner in consumer VR hardware—now partnering with Luxottica on smart glasses frame design. Zuckerberg and Del Vecchio are one ruthlessly ambitious duo for any competitor to contend with.

In passing on the opportunity to work with Safilo, I believe Apple chose poorly. Even though they were not ready for market—the timing wasn’t right for their schedule—they could have acquired Safilo for a song or at the least invested, and helped it rebuild its brand license stable (while wearing Apple’s halo). In any case, that window has long since closed, even the relationship that existed between the companies—Delgado at Safilo and Newson at Apple—have both departed.

If Luxottica is flirting with Facebook, given Safilo’s past collaboration with Google, they should explore an acquisition. With Android, Google is accustomed to being an ingredient in other companies’ products. The brand licensing model works with their culture, and could transfer well to the eye-frames industry’s brand licensing approach. Their own smart glasses platform could then be offered as an option across labels (since acquiring NORTH, they’ve been very quiet on the consumer front).

One of the craziest yet most common lines of argument I get when talking to people in the tech industry about the Italian eye-frames industry is their belief that the government needs to step in and break up Luxottica. It generally goes something like this: “That whole Italian eye-frames industry is really just one big company, did you know that? They’re called Luxottica, they own the whole industry!” as they attempt to educate me.

…followed with some platitude about how, if Luxottica with their “monopoly” is going to stand in the way of consumer smart glasses adoption, the government really needs to step in and break them up… you know, for the good of technological progress… or something. It would be too unserious to address in this article as a legitimate point of view, were the idea not so pervasive in the tech industry, as to seem almost ubiquitous.

I would like to believe this article is informative on multiple levels, but if one takes nothing more away, it should be this: No, the government is not going to step in and save Silicon Valley from Luxottica. Simply reading that prior sentence out loud ought to disabuse one of the notion on its sheer absurdity, but to add some comic relief to an otherwise serious business treatise, let me address this as if it had merit.

Today the combined EssilorLuxottica enjoys 73% marketshare in net retail sales of premium eyewear in the US market (but only 27% globally)—but what does that mean in the current market? Given that Google—with 92% global search market share, and a market cap of $1.7T—is entering the eyewear market; given that Amazon—with 49% US e-commerce market share, and a $1.7T market cap—is entering the eyewear market; given that Microsoft—with 76.6% global desktop market share, and a $1.9T market cap—is entering the eyewear market; given that Apple—while without market dominance in any of their core product lines outside of mobile app sales, is nonetheless the world’s largest company with a $2.1T market cap—is also entering the eyewear market… where by comparison, Luxottica has a paltry $79.1B market cap. It has been speculated that within the decade Apple may be the largest employer of opticians in the U.S. market. Given the largest, most powerfully technology companies in the world have revealed their intent to completely disrupt the premium consumer eyewear market, I do not believe that any U.S. court is going to determine that Luxottica’s dominant position lacks competition and—especially for the sake of Silicon Valley—needs to be broken up.

Again, it feels silly even addressing this point of view were it not, in my personal experience, a near ubiquitous talking point in Silicon Valley, whenever the subject of Luxottica is broached in the context of smart glasses.

The tech industry as a whole ought to look more deeply into what they can achieve working with the Italian eye-frames industry in the broadest sense.

Whether Luxottica’s U.S. market dominance in premium eyewear, or Italy’s market dominance in the category around the world, for both design and build quality, Italy is synonymous with high quality eyewear.

In this parting perspective I will make a case to the supply chain managers—at Apple and elsewhere.

I corresponded with a variety of attorneys—including two each in New York, DC, and Brussels, respectively—seeking an expert on international trade law that would go on record regarding the use of Italy as a location of final assembly for smart glasses—more specifically I sought: what advantages might exist in the context of U.S. trade agreements, and tariffs.

While there was a great deal of interest—if nothing else my inquiry was met with fascination, and some informative conversations took place—though no one was at liberty to go on the record and be quoted for an article. A couple were personally inclined, but the decision was ultimately settled by the standard policy of not commenting for an article where there was a potential client conflict of interest. Given the breadth of both the tech and eyewear companies discussed in this article, in every case there was at least one existing client conflict among their firm’s representation.

However, while the legal details are tedious, the basic idea is simple.

“Made in Italy” carries market cache that people have shown a willingness to pay a premium for. This is particularly true of eyewear.

25% tariffs on Chinese imports were set up under the Trump administration. Conventional wisdom was that these would be lifted under a new Biden administration. However, the Biden administration has left the tariffs in place, and furthered signaled this is the new normal. Furthermore, due to geopolitical realities beyond the scope of this article, many American companies are exploring—often times with great difficulty—the means to lessen their supply chain dependence on Chinese manufacturing. Though Chinese manufacturing capabilities have successively moved up the value chain, a great deal of this manufacturing still involves “final assembly.”

The 25% imposed by “Section 301 Tariffs” on goods imported from China could be circumvented—even with some Chinese components—if the product meets the terms described as “Substantial Transformation.” While there is some legal minutia and rigor involved to meet this standard, every indication is that smart glasses final assembly would easily meet this requirement.

Italy enjoys bilateral trade agreements granting it the highest trade partner status with both China and the U.S., such that some components still made in China could remain within a company’s supply chain without penalty, so long as the value add taking place in Italy, together with other components of other origin (supply chains being international), contribute the largest value, to meet the “substantial transformation” requirement.

In addition to the substantial transformation required by U.S. trade law—and some minimal requirements for country of origin exports under EU trade law—Italy itself is one of the most stringent regulatory environments for goods sold under the “Made in Italy” designation. The Italians have a deep understanding of brand value, and do not allow companies to tarnish their national brand by exporting subpar products under the name of Italy.

The challenge as I’ve been warned is that even with a 25% Chinese tariff, that labor costs in China are so low, that Italian labor costs will still likely be higher. So the question is: Does the “Made in Italy” stamp of quality manufacturing, combined with Italian eye-frames design expertise, compounded by geopolitical pressures to lessen supply chain dependencies on Chinese manufacturing, together deliver enough value for Italy to become a lead player in smart glasses manufacturing?

Regardless of what side of the pond one is on, or which industry they’re in, I would suggest this is a strategic imperative both the Silicon Valley tech industry, and the Italian eye-frames industries should strive to achieve. The longterm ramifications could prove significant for both.

You can stay on top of smart glasses, fashion eye-frames, and near-eye optic display systems by following Christopher Grayson on Twitter. He is available for for hire, for smart glasses product strategy, industry analysis, writing / editorial, and for creative direction. You can learn more about him at his website: ChrisGrayson.com. If you reach out to connect on Linkedin, please note that you arrived from GigantiCo in your inquiry or invite.